Stock investment involves high risks and may result in loss of principal. This course only provides teaching of analysis methods and is not a basis for buying or selling.

This is a systematic course focusing on stock analysis methods and practical risk control skills. It does not provide any stock recommendations or profit promises. It helps students establish an independent analysis framework and understand the nature of market risks through case teaching.

Personal insights and educational content from professionals

Core Module

- Market Basics

- Stock Pricing Logic and Macroeconomic Correlation

- Industry Cycle Characteristics and Policy Risk Identification

- Any analysis model has time lag and probability attributes. All historical laws may be broken by policy changes or technological revolutions. It is not recommended to allocate more than 25% of the total position in a single industry.

Stock Investment System Course | Build a knowledge system and master the core of risk control

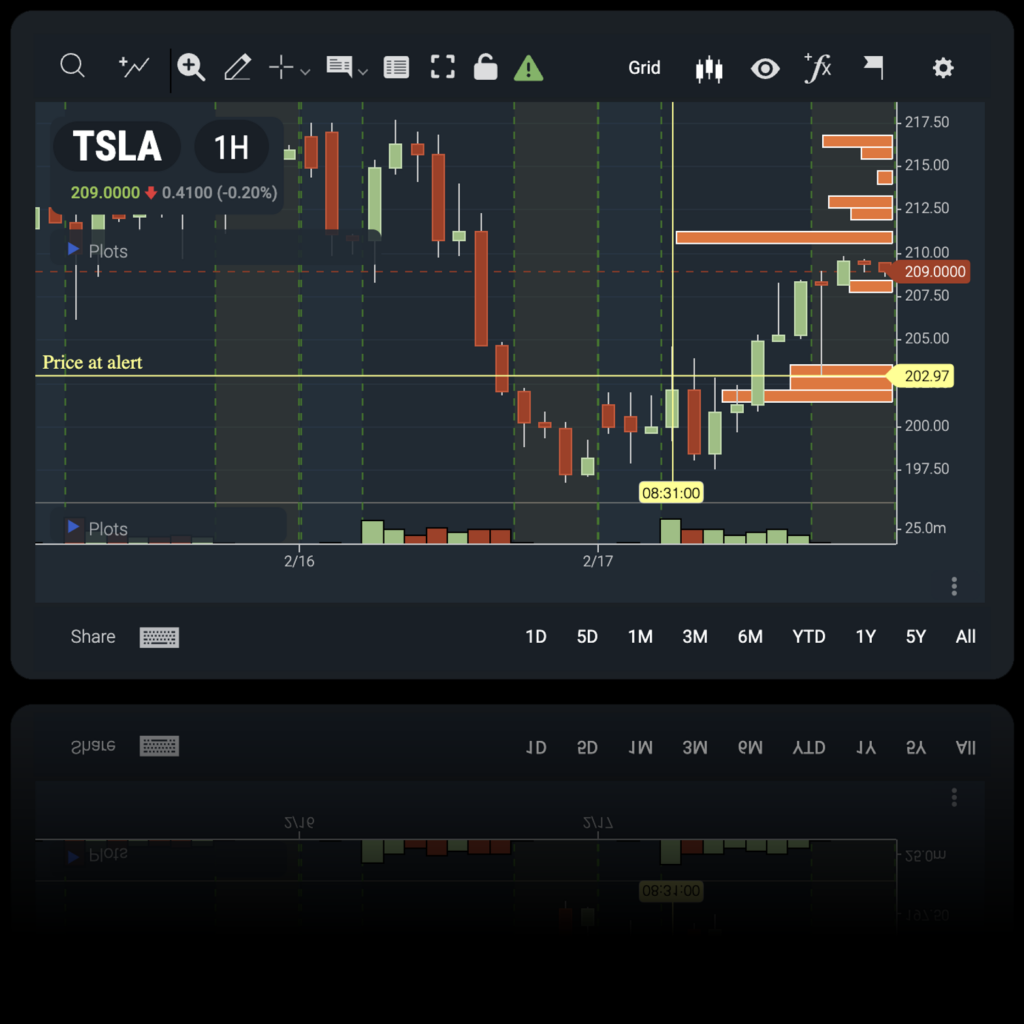

Technical Analysis Practice

- Interpretation of volume-price relationship and trend verification method

- Mathematical modeling and execution discipline of stop-loss strategy

Our Expert Team

Advanced AI trading insights and educational content for professionals Experienced professionals with decades of trading experience

Zoe Chen – Community Manager

Zoe is your first contact in the group. She privately messages daily updates from Mike Wilson, including educational insights on strategies and stock analysis.

As the group’s support assistant, she helps all members get started and stay informed.

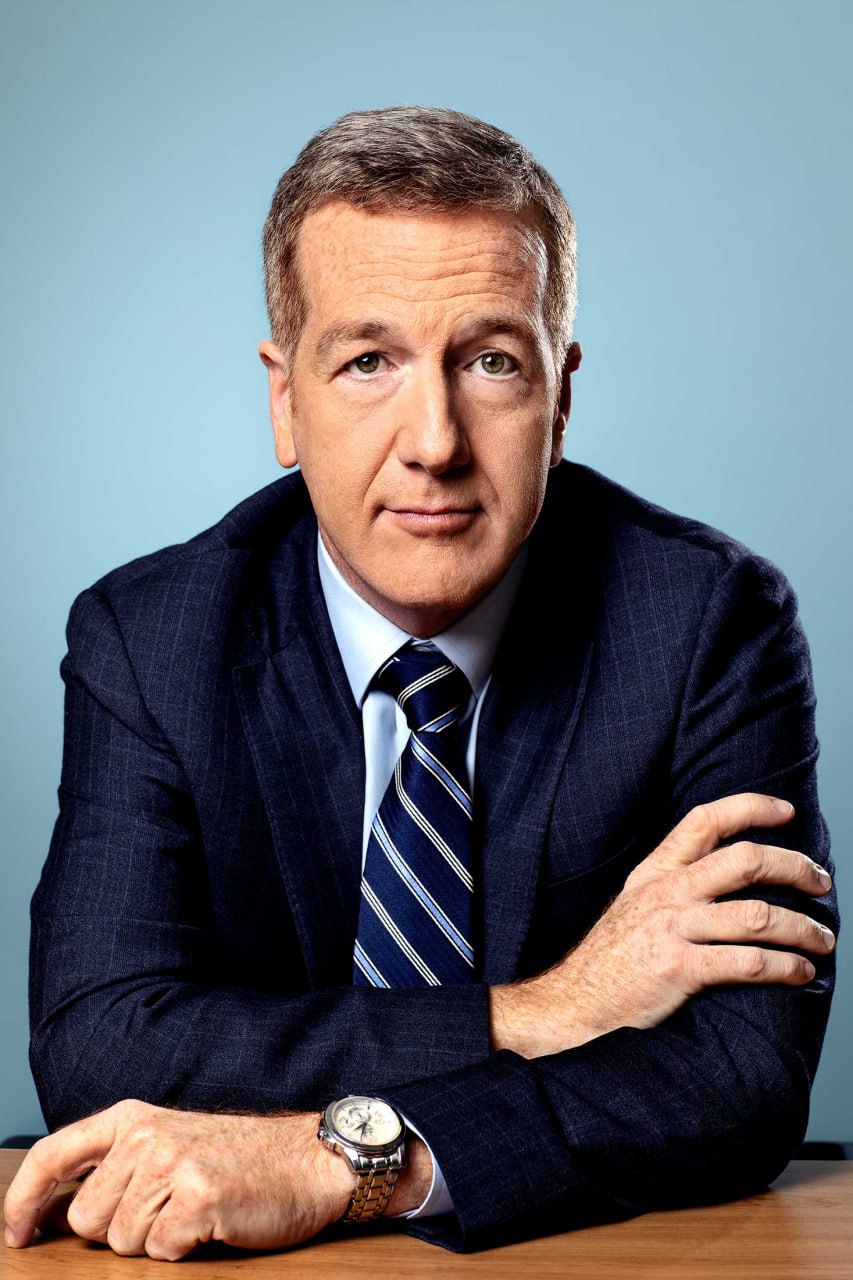

Mike Wilson – Head Mentor, Mike’s Club

Former equity strategist with 12+ years of experience in institutional trading and investor education.

Mike simplifies complex market concepts to help members learn patterns, manage risk, and build confidence.

Swan Liu – Chief Trading Strategist

With over 15 years of institutional trading experience, Swan specializes in identifying repeatable market structures.

He integrates these insights into our AI-assisted scanner logic.

Ready to start learning?

Join our WhatsApp group and discover how experienced mentor Mike Wilson teaches the use of AI and technical analysis to understand market trends and identify quality stocks. Start your learning journey today with thousands of active members in Mike’s Club — a trusted educational community.

FAQ

Can completing the course increase investment returns?

Important statement: This course does not promise any investment returns. The teaching content focuses on: the knowledge system construction of stock analysis methodology, the application principles of risk management tools, and the behavioral training of trading discipline. Systematic learning can reduce the error rate of irrational decision-making (, but there are inherent risks in the market, and investors may face principal losses.

Does the course recommend specific stocks?

The course does not involve any stock recommendations, buy and sell point tips or code analysis, which is the compliance red line of financial education courses. You will learn: the general analysis framework of the relationship between volume and price, objective indicators for industry cycle positioning, mathematical modeling logic of stop-loss strategies, and all cases only use terminated historical data (such as crude oil futures fluctuations in 2008).

Can teachers’ actual performance be used as a reference?

According to global financial regulatory guidelines: past performance shown by teachers does not indicate future results, personal account returns are not replicable, and the core value of the course lies in delivering verifiable methodology. We provide: • Strategy historical backtest data (S&P 500 Index from 2010 to 2023) • Third-party academic papers verifying the conclusions of the analysis model. All materials state that “backtest results do not represent actual returns”

Is the course effective for students with no basic knowledge?

Even if you complete all the courses, investors still need to: verify in a demo account for more than 3 months, and the first real trading funds should not exceed 10% of the investable assets. Understand that all investment decisions must be made at your own risk. If you are concerned about “how to select stocks”, please read Chapter 5 of the “SEC Investor Education Manual” (U.S. Securities and Exchange Commission)

Regulatory compliance: The operation of this platform complies with the provisions of the U.S. Securities and Exchange Commission (SEC) educational guidance, the guidelines of the U.S. Financial Industry Regulatory Authority (FINRA) and the EU MiFID II knowledge product specifications, and the China Securities Regulatory Commission’s “Securities and Futures Investor Suitability Management Measures” stock investment may result in principal loss, and the course content is not used as an investment basis. Disclaimer: By joining, you agree to receive only educational content. Stock investment in this content may result in the total loss of principal, and the course does not constitute any form of investment advice. Historical case data source: CRSP/Wind (1990-2025), backtest results do not predict future performance.

© 2024 All rights reserved